Understanding FICO Score

Note from TVS: There is no FICO Score which is specific to tenant screening. TVS uses Fico Classic 4 which was recommended by Trans Union for the permissible purpose of tenant screening. The Score is only an Indicator, there are many other factors to consider when making a decision to rent. Refer to the Recommendations page of the Tenant Credit Report.

The Fico Score is indicative of good and bad pay habits, there are many factors (algorithms) that are taken into consideration by Fico to score a credit history. We have seen high scores for some Individuals that dont make sense. Without going into great detail...you should know that the FICO score is a guide to determine credit worthiness. When screening tenants you should determine tenant worthiness. i.e. rent payments made on time, stable employment, met all previous lease obligations etc

What exactly is a FICO score?

FICO score is a 3-digit number which represents an estimate of your financial credit worthiness. It is the most important number lenders used to determine who qualifies for a loan, at what interest rate, and to what credit limits.

It is based on a subset of the information in your credit report, typically from the three major American credit bureaus: Equifax, Experian, and TransUnion. Though the scoring system used by all three credit bureaus are different but all point to one conclusion and that is whether or not you have good or bad credit.

Creditors or lenders, such as banks and credit card companies, primarily use FICO scores to determine credit limits and interest rates every time when you apply for new credit card, mortgage, auto loan, personal credit line or any other credit issues by the bank. This scores have proven to be very predictive in assessing the creditworthiness of a person or the likelihood that person will pay his or her debts.

FICO Score Chart

FICO score ranges between 300 to 850. The higher your credit score, the lower the risk is to the lenders and the easier it should be to obtain a loan. A low score, such as 500, could result in much higher interest rates or having your application rejected outright. Conversely, those with a credit score of 760-850 would get the most favorable interest rates.

The following FICO Score Chart may help you to determine where your score is in relation to others.

|

Grade |

EXCELLENT |

GREAT |

GOOD |

FAIR |

POOR |

BAD |

|

Score Range |

850-760 |

759-700 |

699-660 |

659-620 |

619-580 |

579-300 |

What's In FICO Score?

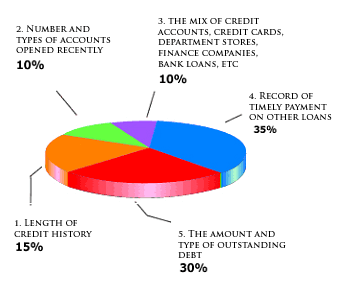

A credit score can be broken down into 5 components, some carry more weight than the others.

Since the bulk of your credit score comes from your payment history and the amount you owe, its important to keep a healthy balance and ensure that you always make your payment on time.

What is a Good FICO Score?

When looking at the chart above, one can see that 660 and above is a good score.

It should be noted that many tenants with a bad or low score are actually good tenants. They make their rent payment on time. A landlord should take the time to determine tenant worthiness by calling current and previous landlord. Any late or outstanding rent payments? Were all of the lease obligations adhered to? Would you rent to this Individual again? This should also be part of your tenant background check, tenant screening, renters background check.

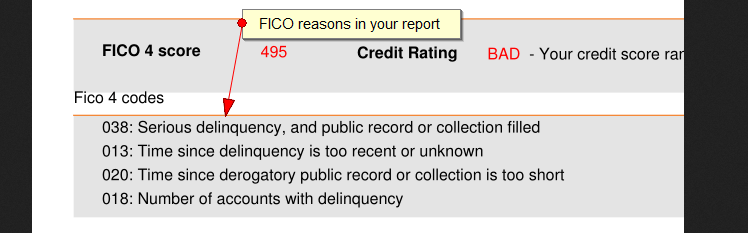

FICO Reason Codes

The reason codes above are explanation factors based on their relative impact on the score. The higher the score, the less the negative impact these factors have. The lower the score, the greater the negative impact these factors have. The Trade Accounts and whether they are paid on time or not... contribute to the factors. Look at the Trade Accounts to see how many were paid on time and how many were not. Focus on the score and the information in the trade accounts.